| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

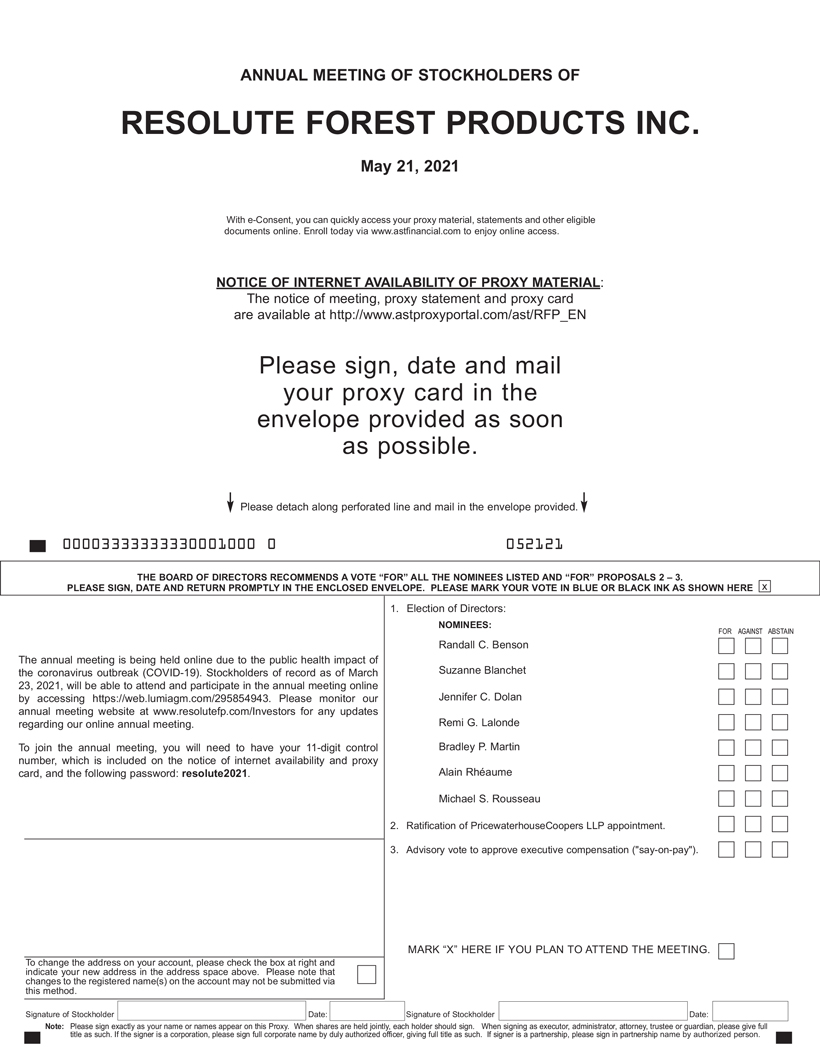

| | | | | | Option Awards | | | Stock Awards | |

| | | Grant Date(1) | | | Number of Securities

Underlying

Unexercised Options | | | Option

Exercise

Price | | | Option

Expiration

Date | | | Number of

Shares or

Units of

Stock That

Have Not

Vested | | | Market

Value of

Shares or

Units That

Have Not

Vested(2) | |

Name | | Exercisable | | | Unexercisable | |

| | | | | | | |

Jacques Vachon | | | 01/09/2011 | (3) | | | 25,203 | | | | — | | | $ | 23.05 | | | | 01/09/2021 | | | | — | | | $ | — | |

| | | 11/03/2011 | (3) | | | 21,606 | | | | — | | | | 16.45 | | | | 11/03/2021 | | | | — | | | | — | |

| | | 11/08/2012 | (3) | | | 37,064 | | | | — | | | | 11.41 | | | | 11/08/2022 | | | | — | | | | — | |

| | | 11/06/2013 | (3) | | | 26,652 | | | | — | | | | 15.66 | | | | 11/06/2023 | | | | — | | | | — | |

| | | 11/13/2017 | | | | — | | | | — | | | | — | | | | — | | | | 7,554 | (4) | | | 49,403 | |

| | | 11/13/2017 | | | | — | | | | — | | | | — | | | | — | | | | 30,218 | (5) | | | 197,626 | |

| | | 11/12/2018 | | | | — | | | | — | | | | — | | | | — | | | | 9,862 | (6) | | | 64,497 | |

| | | 11/12/2018 | | | | — | | | | — | | | | — | | | | — | | | | 19,724 | (7) | | | 128,995 | |

| | | 11/11/2019 | | | | — | | | | — | | | | — | | | | — | | | | 42,981 | (8) | | | 281,096 | |

| | | 11/11/2019 | | | | — | | | | — | | | | — | | | | — | | | | 57,308 | (9) | | | 374,794 | |

| | | 11/16/2020 | | | | — | | | | — | | | | — | | | | — | | | | 44,792 | (10) | | | 292,940 | |

| | | 11/16/2020 | | | | — | | | | — | | | | — | | | | — | | | | 44,792 | (11) | | | 292,940 | |

| 1. | The equity awards made to the named executive officers that were outstanding as of December 31, 2020, were the stock options granted in 2011 through 2013, the RSUs granted in 2017 through 2020, and PSUs granted in 2017 through 2020 under the equity incentive plan. In 2014, the compensation committee ceased granting stock options and began granting PSUs instead. |

| 2. | The fair market value shown is based on the per-share closing trading price on the NYSE of shares of the company’s common stock on December 31, 2020, or $6.54. |

| 3. | These awards are fully vested and exercisable. |

| 4. | The 2017 RSU award vests ratably in one-fourth tranches on December 1 of each calendar year following March 15,pro rata basedthe year of grant: December 1, 2021. The first three tranches vested December 1, 2018, December 1, 2019, and December 1, 2020. As described in the CD&A, Mr. Lalonde was not eligible to receive an equity grant in 2017. |

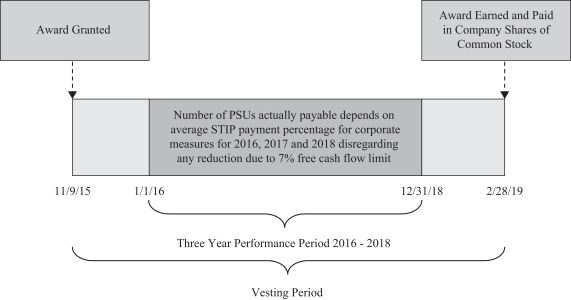

| 5. | The 2017 PSU vested on February 28, 2021, with the number of shares paid out dependent on the average actual payout percentage for corporate measures under the STIP for 2018, 2019, and 2020. Based on the completedaverage STIP payout for these years before payout |

|

Key Definitions |

| |

“Disability”

| | The named executive officer’s eligibility for long-term disability benefits under a Company-sponsored plan |

| |

“Retirement”

| | • Attainment(before application of age 58; and

• Completionthe applicable free cash flow limit), 113.2% of at least two years of service; and

• Having a combined age and years of service (counting partial years) equal to at least 62.5; and

• Not being entitledthe PSUs granted in 2017 were paid out. As described in the CD&A, Mr. Lalonde was not eligible to receive a severance package

|

Employment Agreements and Offer Letters

The material terms of each officer’s employment arrangement are identified below, but any severance arrangement to which a named executive officer may be subject upon certain termination events, whether or not in connection with a change in control, is described below under Severance and Change in Control Arrangements.

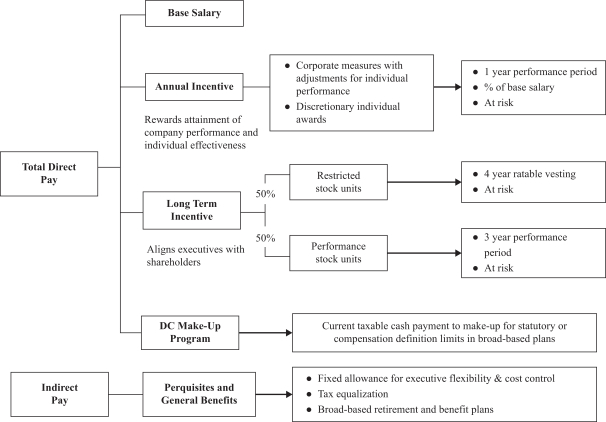

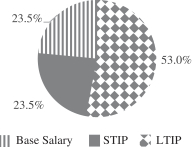

Mr. Garneau

The Company entered into an amended and restated employment agreement with Mr. Garneau, dated February 26, 2014. The employment agreement continues in effect until death, disability, retirement or written notice of termination by Mr. Garneau or the Company, with certain ongoing restrictive covenants as described below. Mr. Garneau’s employment agreement provides for an annual base salary, subject to periodic adjustments. His base salary is evaluated annually by the compensation committee. TheBase Salary section of this narrative disclosure provides more detail regarding his 2015 base salary. Under the terms of his employment agreement, Mr. Garneau is also eligible to receive an annual incentive, as approved by the independent members of the board, under the Company’s annual short-term incentive plans adopted from time to time. In addition, under his employment agreement, Mr. Garneau is eligible to receive awards under the equity incentive plan and other benefits and perquisites.

Mr. Garneau is subject to a covenant not to disclose confidential information during the term of the agreement and for five years thereafter. In addition, Mr. Garneau is subject to covenants not to compete with the Company, solicit customers of the Company or interfere with suppliers of the Company during the term of the agreement and, except as provided in his change in control agreement, for nine months thereafter (12 months in the case of a termination for “cause” (as defined under the employment agreement)).

Ms. Longworth and Messrs. Laflamme, Piché and Tremblay

Ms. Longworth and Messrs. Laflamme, Piché and Tremblay were employed pursuant to the following offer letters entered into with the Company:

| | | | |

Name

| | Effective Date

| | Position on Effective Date

|

| | |

Jo-Ann Longworth

| | August 31, 2011 | | Senior vice president and chief financial officer |

| | |

Yves Laflamme

| | January 17, 2011 | | Senior vice president, wood products, procurement and information technology |

| | |

André Piché

| | February 4, 2014 | | Senior vice president, pulp and paper operations |

| | |

Richard Tremblay

| | February 4, 2014 | | Senior vice president, pulp and paper operations |

The offer letters entered into with Ms. Longworth and Messrs. Laflamme, Piché and Tremblay provide for an annual base salary. Base salaries are evaluated annually by the compensation committee. TheBase Salary section of this narrative disclosure provides more detail regarding the 2015 base salaries for Ms. Longworth and Messrs. Laflamme, Piché and Tremblay.

Under their offer letters, Ms. Longworth and Messrs. Laflamme, Piché and Tremblay were eligible to receive annual incentives under the annual short-term incentive plans adopted by the Company from time to time, with a target payout of 100% of base salary. In 2015, they participated in the 2015 STIP with the same payout potential. They were also eligible to receive awards under the equity incentive plan, as determined by the board. Additionally, throughout their periods of employment in 2015, Ms. Longworth and Messrs. Laflamme, Piché and Tremblay were eligible for other benefits and perquisites.

Equity Awards

Outstanding Equity Awards at Fiscal Year-End 2015

The equity awards made to the named executive officers that were outstanding as of December 31, 2015 were the stock options granted in 2011 through 2013, the RSUs granted in 2012 through 2015, and PSUs granted in 2014 and 2015 under the equity incentive plan. The terms of the 2015 annual equity award are described in the narrative disclosure to the Summary Compensation Table and Grants of Plan-Based Awards table. The 2011 and 2012 annual equity awards have the same terms. The 2013 annual equity award generally mirrors the 2011 and 2012 annual equity award. As described in the CD&A, in 2014, the compensation committee retained the grant of RSUs on generally the same terms as the 2011 through 2013 awards, but replaced stock options with PSUs. RSUs and PSUs were again granted in 2015 on generally the same terms as the 2014 awards.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Option Awards | | | Stock Awards | |

| | | | | | Number of Securities

Underlying

Unexercised Options | | | Option

Exercise

Price | | | Option

Expiration

Date | | | Number of

Shares or

Units

of Stock

That

Have Not

Vested | | | Market

Value of

Shares or

Units

That Have

Not

Vested(8) | |

Name | | Grant

Date | | | Exercisable | | | Unexercisable | | | | | |

Richard Garneau | | | 01/09/2011 | | | | 9,302 | | | | — | (1) | | $ | 23.05 | | | | 01/09/2021 | | | | — | | | $ | — | |

| | | 11/06/2013 | | | | 66,031 | | | | 66,030 | (3) | | | 15.66 | | | | 11/06/2023 | | | | — | | | | — | |

| | | 11/06/2013 | | | | — | | | | — | | | | — | | | | — | | | | 32,256 | (3) | | | 244,178 | |

| | | 11/06/2014 | | | | — | | | | — | | | | — | | | | — | | | | 43,632 | (4) | | | 330,294 | |

| | | 11/06/2014 | | | | — | | | | — | | | | — | | | | — | | | | 58,177 | (5) | | | 440,400 | |

| | | 11/09/2015 | | | | — | | | | — | | | | — | | | | — | | | | 148,873 | (6) | | | 1,126,969 | |

| | | 11/09/2015 | | | | — | | | | — | | | | — | | | | — | | | | 148,873 | (7) | | | 1,126,969 | |

| | | | | | | |

Jo-Ann Longworth | | | 11/03/2011 | | | | 26,166 | | | | — | (1) | | | 16.45 | | | | 11/03/2021 | | | | — | | | | — | |

| | | 11/08/2012 | | | | 36,283 | | | | 12,094 | (2) | | | 11.41 | | | | 11/08/2022 | | | | — | | | | — | |

| | | 11/08/2012 | | | | — | | | | — | | | | — | | | | — | | | | 5,925 | (2) | | | 44,852 | |

| | | 11/06/2013 | | | | 17,818 | | | | 17,817 | (3) | | | 15.66 | | | | 11/06/2023 | | | | — | | | | — | |

| | | 11/06/2013 | | | | — | | | | — | | | | — | | | | — | | | | 8,704 | (3) | | | 65,889 | |

| | | 11/06/2014 | | | | — | | | | — | | | | — | | | | — | | | | 10,917 | (4) | | | 82,642 | |

| | | 11/06/2014 | | | | — | | | | — | | | | — | | | | — | | | | 14,557 | (5) | | | 110,196 | |

| | | 11/09/2015 | | | | — | | | | — | | | | — | | | | — | | | | 35,222 | (6) | | | 266,631 | |

| | | 11/09/2015 | | | | — | | | | — | | | | — | | | | — | | | | 35,222 | (7) | | | 266,631 | |

| | | | | | | |

Yves Laflamme | | | 01/09/2011 | | | | 24,092 | | | | — | (1) | | | 23.05 | | | | 01/09/2021 | | | | — | | | | — | |

| | | 11/03/2011 | | | | 6,354 | | | | — | (1) | | | 16.45 | | | | 11/03/2021 | | | | — | | | | — | |

| | | 11/08/2012 | | | | 10,614 | | | | 10,614 | (2) | | | 11.41 | | | | 11/08/2022 | | | | — | | | | — | |

| | | 11/08/2012 | | | | — | | | | — | | | | — | | | | — | | | | 5,200 | (2) | | | 39,364 | |

| | | 11/06/2013 | | | | 7,633 | | | | 15,265 | (3) | | | 15.66 | | | | 11/06/2023 | | | | — | | | | — | |

| | | 11/06/2013 | | | | — | | | | — | | | | — | | | | — | | | | 7,456 | (3) | | | 56,442 | |

| | | 11/06/2014 | | | | — | | | | — | | | | — | | | | — | | | | 9,354 | (4) | | | 70,810 | |

| | | 11/06/2014 | | | | — | | | | — | | | | — | | | | — | | | | 12,472 | (5) | | | 94,413 | |

| | | 11/09/2015 | | | | — | | | | — | | | | — | | | | — | | | | 30,473 | (6) | | | 230,681 | |

| | | 11/09/2015 | | | | — | | | | — | | | | — | | | | — | | | | 30,473 | (7) | | | 230,681 | |

| | | | | | | |

André Piché | | | 01/09/2011 | | | | 9,868 | | | | — | (1) | | | 23.05 | | | | 01/09/2021 | | | | — | | | | — | |

| | | 11/03/2011 | | | | 9,569 | | | | — | (1) | | | 16.45 | | | | 11/03/2021 | | | | — | | | | — | |

| | | 11/08/2012 | | | | 13,149 | | | | 4,382 | (2) | | | 11.41 | | | | 11/08/2022 | | | | — | | | | — | |

| | | 11/08/2012 | | | | — | | | | — | | | | — | | | | — | | | | 2,147 | (2) | | | 16,253 | |

| | | 11/06/2013 | | | | 6,303 | | | | 6,303 | (3) | | | 15.66 | | | | 11/06/2023 | | | | — | | | | — | |

| | | 11/06/2013 | | | | — | | | | — | | | | — | | | | — | | | | 3,078 | (3) | | | 23,300 | |

| | | 11/06/2014 | | | | — | | | | — | | | | — | | | | — | | | | 8,410 | (4) | | | 63,664 | |

| | | 11/06/2014 | | | | — | | | | — | | | | — | | | | — | | | | 11,214 | (5) | | | 84,890 | |

| | | 11/09/2015 | | | | — | | | | — | | | | — | | | | — | | | | 28,499 | (6) | | | 215,737 | |

| | | 11/09/2015 | | | | — | | | | — | | | | — | | | | — | | | | 28,499 | (7) | | | 215,737 | |

| | | | | | | |

Richard Tremblay | | | 11/03/2011 | | | | 11,483 | | | | — | (1) | | | 16.45 | | | | 11/03/2021 | | | | — | | | | — | |

| | | 11/08/2012 | | | | 13,453 | | | | 4,484 | (2) | | | 11.41 | | | | 11/08/2022 | | | | — | | | | — | |

| | | 11/08/2012 | | | | — | | | | — | | | | — | | | | — | | | | 2,197 | (2) | | | 16,631 | |

| | | 11/06/2013 | | | | 6,718 | | | | 6,717 | (3) | | | 15.66 | | | | 11/06/2023 | | | | — | | | | — | |

| | | 11/06/2013 | | | | — | | | | — | | | | — | | | | — | | | | 3,281 | (3) | | | 24,837 | |

| | | 11/06/2014 | | | | — | | | | — | | | | — | | | | — | | | | 8,410 | (4) | | | 63,664 | |

| | | 11/06/2014 | | | | — | | | | — | | | | — | | | | — | | | | 11,214 | (5) | | | 84,890 | |

| | | 11/09/2015 | | | | — | | | | — | | | | — | | | | — | | | | 30,692 | (6) | | | 232,338 | |

| | | 11/09/2015 | | | | — | | | | — | | | | — | | | | — | | | | 30,692 | (7) | | | 232,338 | |

1. | These awards are fully vested and exercisable. |

2. | Vests ratably in one-fourth tranches on each anniversary of the grant date: November 8, 2016. The first tranche vested November 8, 2013, the second tranche vested November 8, 2014 and the third tranche vested November 8, 2015.2017. |

3.6. | VestsThe 2018 RSU award vests ratably in one-fourth tranches on December 1 of each anniversary of the grant date: November 6, 2016calendar year: December 1, 2021, and November 6, 2017.December 1, 2022. The first tranchetwo tranches vested November 6, 2014December 1, 2019, and the second tranche vested November 6, 2015.December 1, 2020. |

4.7. | Vests ratably in one-fourth tranches on each anniversary of the grant date: November 6, 2016, November 6, 2017 and November 6, 2018. The first tranche vested November 6, 2015. |

5. | Unvested2018 PSU award is unvested until February 28, 2018.2022. The award will become 100% vested on February 28, 2018,2022, with the number of shares paid out dependent on performance conditions as described in the narrative disclosure toCD&A for the Summary Compensation Table.2018 proxy. |

6.8. | VestsThe 2019 RSU award vests ratably in one-fourth tranches on December 1 of each anniversary of the grant date: November 9, 2016, November 9, 2017, November 9, 2018calendar year: December 1, 2021, December 1, 2022, and November 9, 2019.December 1, 2023. The first tranche vested December 1, 2020. |

7.9. | UnvestedThe 2019 PSU award is unvested until February 28, 2019.2023. The award will become 100% vested on February 28, 2019,2023, with the number of shares paid out dependent on performance conditions as described in the narrative disclosure toCD&A for the Summary Compensation Table.2019 proxy. |

8.10. | The fair market value shown2020 RSU award vests ratably in one-fourth tranches on December 1 of each calendar year: December 1, 2021, December 1, 2022, December 1, 2023, and December 1, 2024. |

| 11. | The 2020 PSU award is basedunvested until February 28, 2024. The award will become 100% vested on February 28, 2024, with the per-share closing trading price on the NYSEnumber of shares ofpaid out dependent on performance conditions as described in the Company’s common stock on December 31, 2015, or $7.57.CD&A. |